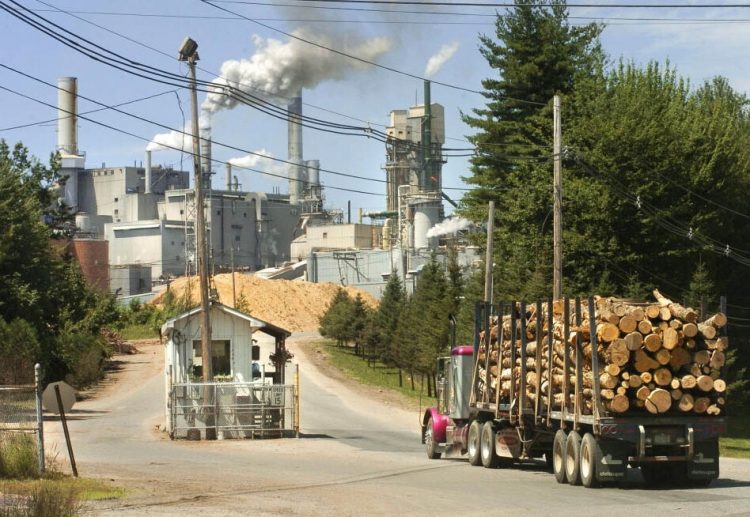

After months of drama involving a rogue shareholder group that tried to scuttle the deal, Ohio-based Verso Corp. has completed the sale of its Androscoggin Mill in Jay to Pixelle Specialty Solutions LLC, a paper manufacturer based in Pennsylvania.

The $400 million transaction also included the sale of Verso’s Stevens Point Mill in Stevens Point, Wisconsin. Verso announced Monday in a news release that its long-planned sale of the two mills had been completed, and that it “will promptly announce how it plans to utilize no less than $225 million and up to $282 million of the net cash proceeds from the transaction for the benefit of stockholders.”

Verso did not speculate on how the sale to Pixelle could affect the Androscoggin Mill’s roughly 500 employees. Pixelle has told the Portland Press Herald it would not discuss the possible impact of the transaction until after the sale was completed.

Pixelle issued a news release touting the variety of products and wealth of expertise it now commands following its acquisition of the two mills. Pixelle said the deal makes it the largest specialty paper business in North America.

“Customers now have access to the specialty papers industry’s largest assembly of technical expertise, product knowledge, skilled labor and production capabilities,” Pixelle CEO Timothy Hess said in a statement. “At this industry-leading scale, we can provide customers with advanced capabilities such as barrier coatings, customized coating technologies, release and casting chemistries, inkjet innovations, document security, and short-run custom colors.”

Pixelle did not respond Monday to a request for information about whether and how the ownership change would affect mill workers.

Verso first announced in November that it had agreed to sell the two mills, which have a combined market value of roughly $400 million. The company said it would use proceeds from the sale to bolster its already strong financial position and reward shareholders.

“We are pleased to have completed the sale of our Androscoggin and Stevens Point mills to Pixelle,” Verso CEO Adam St. John said in a statement Monday. “After the transaction, we will continue to be a debt-free company with significant manufacturing and financial flexibility, well positioned to enhance our competitive market position, effectively respond to industry trends and take advantage of low-risk, high-return opportunities that should create long-term value for all of our stakeholders.”

At times since the acquisition was first proposed, it seemed as if the deal might be in jeopardy. Verso warned its shareholders in December that a bid by dissident investors to seize control of the company’s board of directors could jeopardize the sale of the two mills.

At Verso’s annual shareholders’ meeting in January, a pair of private equity firms that also own a Verso competitor, Twin Rivers Paper Co. in Madawaska, had backed their own slate of candidates for a board election. Those candidates were critical of the company’s existing management and some of its recent financial decisions.

The dissident investors were especially critical of Verso management’s decision in August 2019 to upgrade two paper machines in Jay to make specialty products as part of a $120 million investment at three of its mills. The investors said the money spent on upgrades should have been distributed among shareholders.

Verso had warned that electing the board members favored by the private equity firms, Atlas Holdings of Connecticut and Blue Wolf Capital Partners of New York, likely would pave the way for a merger of Verso and Twin Rivers, and derail the sale to Pixelle.

However, just hours before the Jan. 31 shareholders’ meeting, Verso and the two private equity firms announced an end to their battle over nominees to the paper company’s board of directors.

Send questions/comments to the editors.

Comments are no longer available on this story