WASHINGTON — The Education Department is considering only partially forgiving federal loans for students defrauded by for-profit colleges, The Associated Press has learned, abandoning the Obama administration’s policy of fully erasing that debt.

Under President Obama, tens of thousands of students deceived by now-defunct for-profit schools had over $550 million in such loans canceled completely.

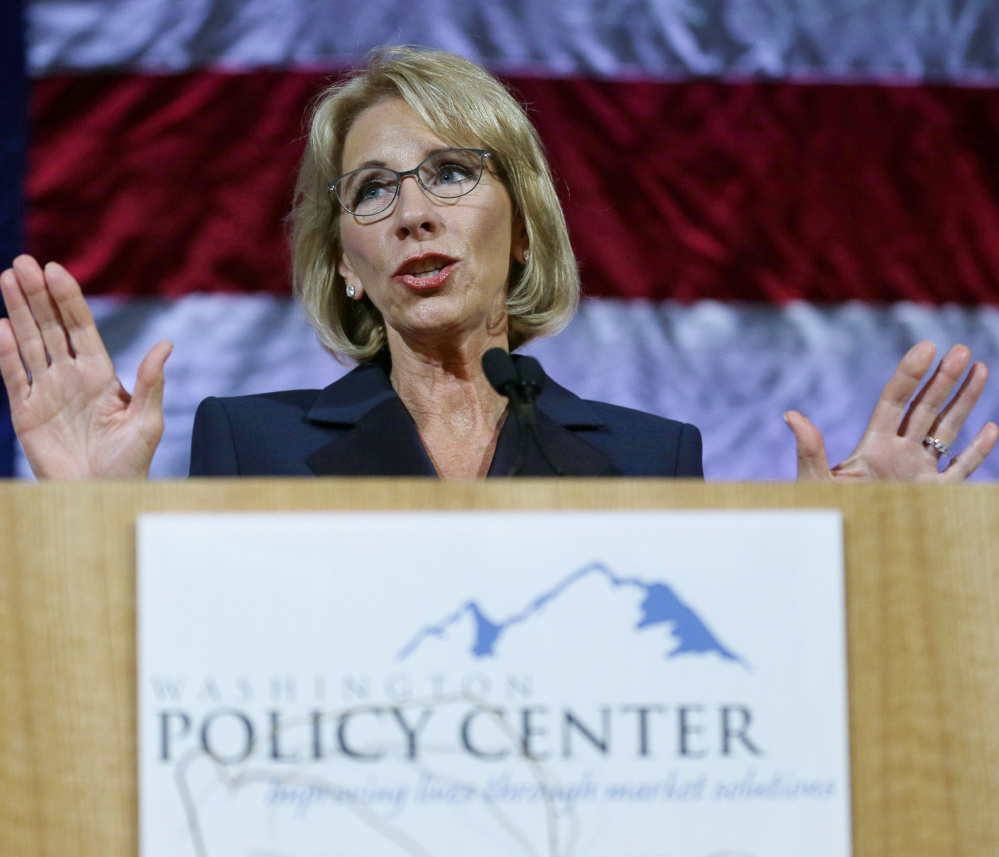

But President Trump’s education secretary, Betsy DeVos, is working on a plan that could grant such students just partial relief, according to department officials who spoke on condition of anonymity. The department may look at the average earnings of students in similar programs and schools to determine how much debt to wipe away.

If DeVos goes ahead, the change could leave many students scrambling after expecting full loan forgiveness, based on the previous administration’s track record.

It was not immediately clear how many students might be affected.

But the Trump team has given hints of a new approach.

In August, the department extended its contract with a staffing agency to speed up the processing of a backlog of loan forgiveness claims. In the procurement notice, the department said that “policy changes may necessitate certain claims already processed be revisited to assess other attributes.”DeVos’ review prompted an outcry from student loan advocates, who said the idea of giving defrauded students only partial loan relief was unjustified and unfair because many of their classmates had already gotten full loan cancellation. Critics say the Trump administration, which has ties to the for-profit sector, is looking out for industry interests.

Earlier this year, Trump paid $25 million to settle charges his Trump University misled students.

“Anything other than full cancellation is not a valid outcome,” said Eileen Connor, a litigator at Harvard University’s Project on Predatory Student Lending, which has represented hundreds of defrauded students of the now-shuttered Corinthian Colleges.

“The nature of the wrong that was done to them, the harm is even bigger than the loans that they have.”

Send questions/comments to the editors.

Comments are no longer available on this story