Exports of civilian aircraft, aviation engines and parts jumped more than 30 percent last year, becoming Maine’s second-most valuable export industry after seafood, according to federal trade data.

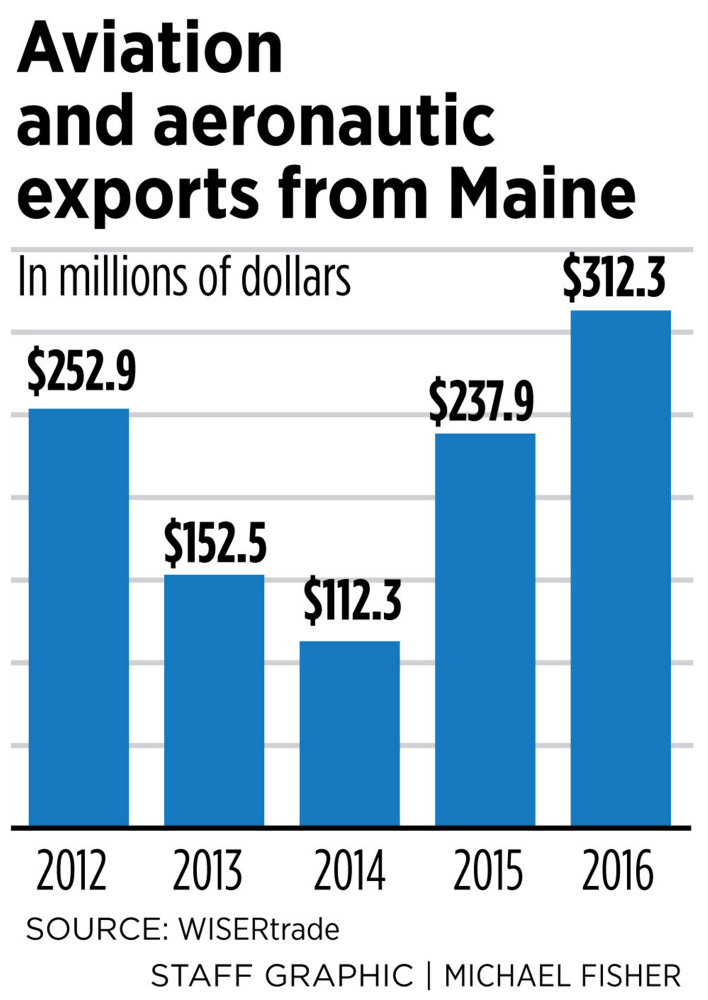

The total dollar value of Maine’s aerospace exports was a record $312 million last year, about 11 percent of the state’s $2.8 billion in foreign exports. Though Maine’s aviation exports declined between 2012 and 2015, the value has risen dramatically overall in the last decade, jumping more than 700 percent, from $37.8 million in 2006 to last year’s record.

The increase in exports from the aerospace industry coincides with declining export value in electric machinery, paper and wood products. Trade data can sometimes be misleading or incomplete, said Wade Merritt, vice president of the Maine International Trade Center. In this case, however, the numbers appear to show sustained growth in aviation-related companies.

“There is a trend line there for sure,” Merritt said.

Though it is unclear what company, or companies, are driving the export increase, industry observers suspect that the Pratt & Whitney manufacturing plant in North Berwick is responsible for a good portion of the growth.

Pratt & Whitney, owned by Connecticut-based United Technologies, employs about 1,700 workers in Maine and its North Berwick plant is the state’s largest manufacturing facility under one roof, the company says.

Warehouse specialist Corina Glidden picks aviation parts from a huge inventory at C&L Aviation at the Bangor International Airport in Bangor.

Ray Hernandez, a Pratt & Whitney spokesman, declined to answer questions about exports from Maine. In a statement, the company said the North Berwick plant manufactures parts for its geared turbofan engine, which is used by more than 80 customers in 30 countries. The technology also is used in the F-35 Joint Strike Fighter, a next-generation military jet under development by Lockheed Martin.

“Due to the success of the programs in our portfolio, we anticipate doubling our engine production volumes by the end of the decade,” the company said in a statement.

“To prepare for this significant increase in production, we are investing more than $1.3 billion in our manufacturing network, which includes more than $125 million in capital investments in our North Berwick, Maine, facility over the last several years.”

Pratt & Whitney’s turbofan engine is an option on passenger jets manufactured by France’s Airbus and the Russian Irkut Corp. It also is used as the exclusive engine provider for some jets manufactured by Bombardier, headquartered in Montreal; Embraer, from Brazil; and Mitsubishi, in Japan.

Plane wings are stacked from floor to ceiling at C&L Aviation’s Bangor warehouse at the Bangor International Airport.

Germany was the top destination for Maine’s aviation industry last year, accounting for $177 million, according to federal data. Canada was the second-biggest importer, followed by Japan and the United Kingdom.

Aerospace is the United States’ third most valuable export industry, providing $134 billion in trade in 2016, according to the U.S. International Trade Administration. U.S. companies could further benefit from worldwide demand for commercial passenger aircraft. A 2013 forecast from PricewaterhouseCoopers estimated that between 2013-2032, there would be global demand for 35,000 aircraft with a total value of $4.8 trillion.

Although Pratt & Whitney certainly accounts for much of Maine’s aerospace exports, other aviation companies also are looking to international markets. Aircraft sales from C&L Aviation Group, based in Bangor, were between $35 million and $45 million last year, and 50-60 percent were international sales, said Pat Lemieux, the company’s marketing director. Its biggest foreign customers are Canada, Japan and Australia, but it also sells to a mix of countries in Europe and Asia, and has sales offices in Australia and the Czech Republic. The company also has a services division based at Bangor International Airport. The company completed a $5 million expansion in 2013 and has grown from 20 employees seven years ago to almost 200 today, Lemieux said.

Pat Lemieux, marketing manager for C&L Aviation, stands in the repair hangar at the company’s Bangor headquarters at the Bangor International Airport.

“As we continue to grow, we expect much of our sales business to continue to come from overseas,” he said.

Small second- and third-tier manufacturers also may be responsible for rising exports, said Lisa Martin, director of the Manufacturers Association of Maine. In 2009, the association started the Maine Aerospace Alliance to develop an aerospace cluster in the state and grew its membership to more than 80 companies, training 46 of them in areas such as licensing and marketing, according to a 2013 report to the Maine Technology Institute, which provided funding for the project. Many of those companies are contracted to make component parts and manufacture small machine products, Martin said.

According to the national Aerospace Industries Association website, 5,170 Maine workers were directly employed in the aerospace industry in 2015. The industry added $700 million to Maine’s GDP and accounted for almost 7 percent of the state’s manufacturing production, the association said.

“Maine is certainly not perceived as a place that did aerospace work, but there is a huge amount of activity that is going on in Maine that we don’t know about or talk about,” Martin said.

Peter McGuire can be contacted at 791-6325 or at:

Send questions/comments to the editors.

Comments are no longer available on this story